Security governance has moved from compliance documentation to operational necessity. With Global Information Governance Day approaching mid-February, it’s worth examining how modern governance frameworks must evolve beyond policy documents to provide boards and regulators with demonstrable risk visibility.

The question isn’t whether your organisation has governance policies. It’s whether those policies translate into measurable risk reduction that executives can understand and regulators can verify.

The Governance Gap: Policy vs. Reality

Most organisations maintain extensive security governance documentation: information security policies, risk management frameworks, compliance matrices, and incident response procedures. These documents satisfy audit requirements and provide theoretical governance structure.

But governance documentation doesn’t prevent breaches. The gap between documented policy and operational reality creates the exposure attackers exploit.

Traditional governance approaches suffer from fundamental disconnects:

Static Assessment: Annual audits and quarterly reviews capture governance posture at single moments, missing the continuous changes in attack surfaces through cloud deployments, API proliferation, and third-party integrations.

Manual Verification: Policy compliance relies on manual checks and self-reporting from business units, creating accuracy problems and resource demands that don’t scale.

Generic Metrics: Governance reporting often uses abstract metrics (number of policies, percentage of staff trained, frequency of reviews) that don’t translate into actual risk reduction boards can understand.

Remediation Lag: Even when governance reviews identify gaps, remediation timelines measured in months rather than weeks leave persistent exposure.

The result is governance theatre: impressive documentation with limited operational impact on security posture.

CTEM: The Operational Foundation for Risk-Aware Governance

Continuous Threat Exposure Management (CTEM) provides the operational framework that transforms governance from documentation exercise to measurable risk management.

Gartner’s research quantifies the impact: organisations prioritising security investments through CTEM programmes will realise a two-thirds reduction in breaches by 2026. This isn’t theoretical improvement – it’s measurable risk reduction that governance frameworks must deliver.

CTEM aligns with governance requirements through five operational phases:

Scoping: Define and continuously update the attack surface requiring governance oversight. This includes applications processing sensitive data, APIs exposing business functionality, infrastructure hosting critical systems, and third-party integrations extending your security perimeter.

Discovery: Automatically identify assets across the technology estate. Attack Surface Management continuously maps internet-facing systems, cloud workloads, and shadow IT that manual governance processes miss.

Prioritisation: Focus governance resources on actual business risk rather than generic compliance checklists. This means understanding which vulnerabilities threaten regulated data, which exposures affect critical business processes, and which risks carry material financial or regulatory consequences.

Validation: Verify that security controls actually work through continuous assessment and expert penetration testing, not just policy documentation claiming they exist.

Mobilisation: Systematic remediation of identified gaps with validation that fixes resolve the underlying risks, not just satisfy audit findings.

This operational cycle provides the continuous visibility and measurable outcomes that effective governance requires.

Translating Technical Risk into Governance Metrics

Boards and regulators don’t understand vulnerability counts or CVSS scores. Effective governance reporting requires translating technical security posture into business risk language executives comprehend.

The translation requires specific capabilities:

Asset Classification: Map technical infrastructure to business functions and data classifications. “Payment processing API has critical authentication vulnerabilities” becomes “Systems handling 2.3 million customer payment records annually have exploitable access control flaws representing £12 million in potential regulatory fines and breach costs.”

Regulatory Alignment: Connect vulnerability findings to specific regulatory obligations. Generic “high severity SQL injection” becomes “database exposure vulnerability affecting GDPR Article 32 security requirements with potential ICO enforcement action.”

Trend Analysis: Show whether governance controls are improving security posture over time. “Critical data exposure vulnerabilities decreased 34% quarter-over-quarter through enhanced API security governance” demonstrates programme effectiveness better than static compliance percentages.

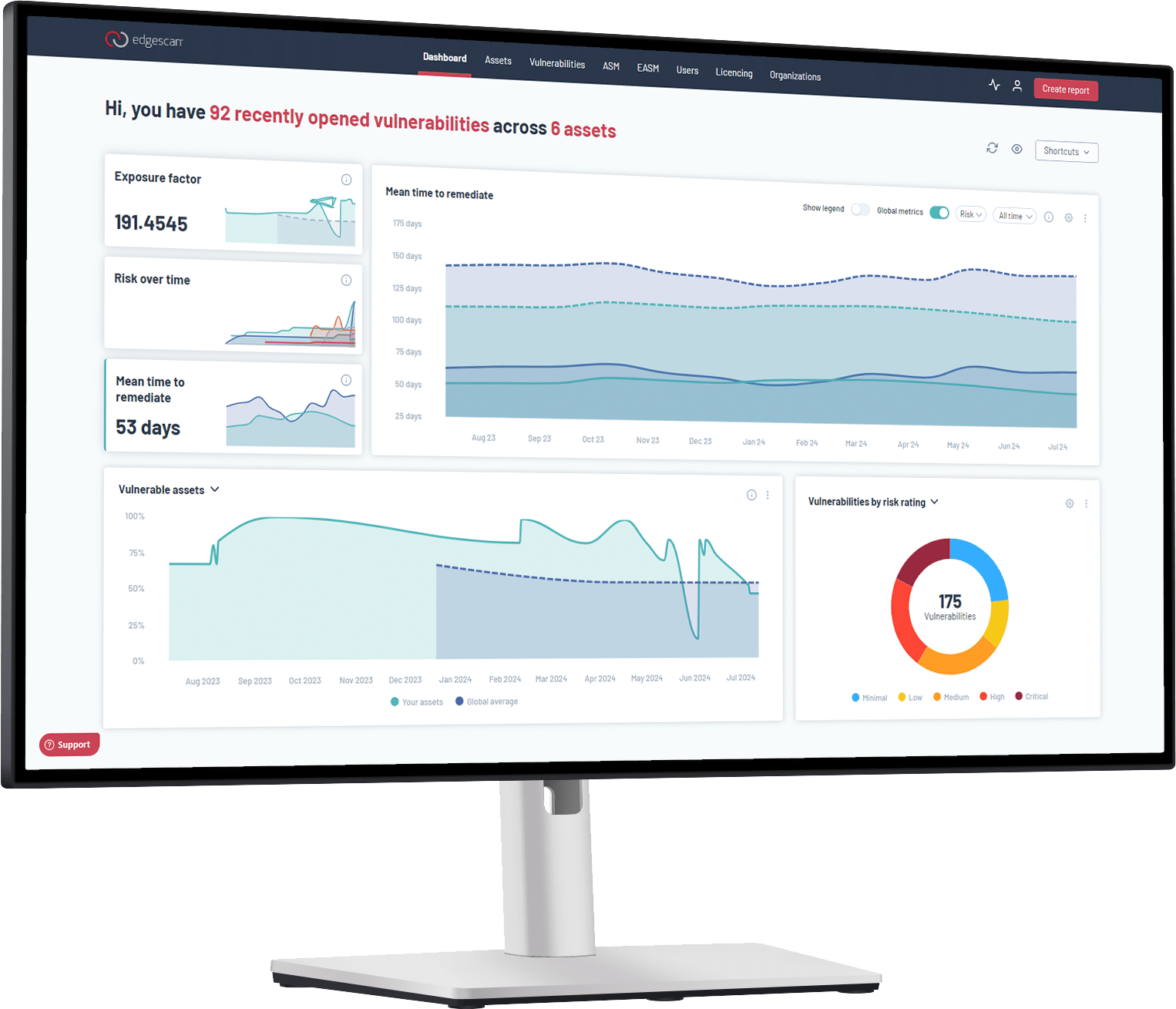

Comparative Context: Benchmark against industry standards. “Our mean time to remediate critical vulnerabilities is 52 days versus industry average of 74 days” provides boards with meaningful context about governance programme maturity.

Third-Party Risk Quantification: Translate vendor security assessments into business impact. “Three critical vendors processing customer data have unresolved high-severity vulnerabilities, representing cascading breach risk estimated at £4.2 million.”

This level of reporting requires security programmes built for continuous assessment and business risk translation, not compliance-only frameworks focused on documentation.

Governance Frameworks and Continuous Assessment

Multiple governance frameworks provide structure for security programmes: ISO 27001, NIST Cybersecurity Framework, PCI DSS, DORA, and sector-specific regulations. Each defines security controls, risk management processes, and compliance requirements.

The challenge isn’t choosing frameworks – it’s operationalising them at the speed modern threat environments demand.

According to the PTaaS Guide, traditional annual penetration testing creates significant exposure windows. Point-in-time assessments complete and immediately begin aging. As soon as testing finishes, it may already be out-of-date given continuous infrastructure changes.

Forrester research shows that more than 70% of firms are now adopting PTaaS specifically because governance requirements can’t be met through periodic assessment alone. The combination of continuous scanning and on-demand expert testing enables governance verification that matches the pace of infrastructure change.

For organisations subject to PCI DSS, compliance explicitly requires both vulnerability scanning and penetration testing with specific frequency and scope requirements. But minimum compliance frequency doesn’t equal adequate governance – it’s the baseline, not the target.

DORA (Digital Operational Resilience Act) for financial services mandates continuous monitoring and regular testing. Static annual assessments don’t satisfy these requirements. Effective governance requires always-on visibility into security posture.

The Compliance Reporting Challenge

Governance programmes generate extensive compliance evidence: vulnerability scan reports, penetration test findings, remediation tracking, and risk assessment documentation. Managing this evidence across multiple frameworks and regulatory requirements creates significant operational overhead.

Traditional approaches to compliance reporting involve:

Manual Compilation: Security teams manually gather evidence from multiple tools, spreadsheets, and project trackers to compile audit packages.

Inconsistent Formatting: Different assessors require different report formats, creating duplicate work reformatting the same underlying data.

Point-in-Time Snapshots: Compliance reports represent security posture at specific audit moments rather than providing ongoing governance visibility.

Limited Automation: Each compliance cycle requires largely manual effort despite addressing the same fundamental security controls.

Modern governance platforms address these challenges through automated compliance mapping. The same vulnerability data that drives remediation also generates compliance reports aligned with ISO 27001, PCI DSS, NIST, and other frameworks without manual reformatting.

Integration with ticketing systems (Jira, ServiceNow) and collaboration tools (GitHub) creates audit trails showing how vulnerabilities were discovered, assigned, remediated, and validated – the complete governance lifecycle documented automatically.

Measuring Governance Programme Effectiveness

Effective governance requires metrics that demonstrate actual security improvement, not just compliance activity.

Key performance indicators should include:

Mean Time to Remediate (MTTR): How quickly identified vulnerabilities are resolved. Decreasing MTTR demonstrates improving governance effectiveness. The industry benchmarks provide context – organisations should track whether their remediation velocity improves relative to these baselines.

Vulnerability Backlog Age: Percentage of findings remaining unresolved after 30, 60, 90 days and beyond. Growing backlogs indicate governance process failures regardless of documentation quality.

Coverage Completeness: Percentage of technology estate under continuous assessment. Gaps in coverage represent governance blind spots where risk accumulates undetected.

False Positive Rate: Percentage of reported findings that don’t represent actual exploitable vulnerabilities. High false positive rates waste remediation resources and erode confidence in security data.

Validation Rate: Percentage of reported vulnerabilities that undergo expert validation versus automated-only detection. Higher validation rates typically correlate with more accurate risk assessment and better remediation prioritisation.

Control Effectiveness: For specific governance controls (encryption, access management, network segmentation), continuous verification that controls work as designed rather than just documented as implemented.

These operational metrics provide boards and audit committees with meaningful governance oversight beyond compliance checkbox reporting.

Building Executive Risk Reporting

CISOs face the challenge of communicating technical security posture to boards focused on business risk, financial exposure, and regulatory obligations.

Effective executive risk reporting for governance requires several elements:

Risk Quantification: Translate vulnerabilities into potential business impact using breach cost data, regulatory fine exposure, and operational disruption estimates. “We have 127 critical vulnerabilities” means nothing to boards. “Payment infrastructure has three critical flaws representing approximately £8 million in potential breach costs and regulatory penalties” drives governance decisions.

Control Maturity: Show progression of security control implementation and effectiveness over time. Governance frameworks aren’t binary pass/fail – they’re maturity journeys. Demonstrating continuous improvement provides confidence in programme direction.

Regulatory Exposure: Map current security posture to specific regulatory requirements with clear identification of gaps and remediation timelines. This matters particularly for GDPR, sector-specific regulations, and emerging requirements like DORA.

Comparative Benchmarking: Context relative to industry peers and standards helps boards understand whether security investment levels and outcomes are appropriate for the organisation’s risk profile.

Forward-Looking Risk: Don’t just report current state – project future risk based on identified trends, upcoming regulatory changes, and evolving threat landscape. Governance is inherently forward-looking.

This reporting level requires platforms that consolidate technical security data, business context, regulatory mapping, and trend analysis into executive-appropriate formats – not just technical vulnerability reports.

Third-Party Governance: The Extended Risk Perimeter

Modern organisations don’t operate as isolated entities. Cloud services, SaaS applications, payment processors, data analytics providers, and countless other third parties access internal systems and process sensitive data.

Each third-party relationship extends your governance perimeter and your risk exposure. Supply chain attacks increasingly target organisations through vendor relationships specifically because third-party security often receives less governance scrutiny than internal systems.

Effective third-party governance requires:

Security Assessment Requirements: Define minimum security standards for vendors based on data sensitivity and system criticality. Not all vendors require the same assessment depth.

Continuous Monitoring: Third-party security posture changes over time. Annual vendor questionnaires don’t capture emerging risks in critical integrations.

Contractual Controls: Security requirements must be enforceable through contracts with clear remediation obligations and breach notification requirements.

Integration Security: APIs and system integrations with third parties require specific security assessment. These connection points often become attack vectors.

Incident Response Coordination: Governance frameworks must address how security incidents involving third parties will be detected, communicated, and resolved.

The same continuous assessment approach that improves internal governance applies to third-party risk management. Platforms that extend security testing to vendor integrations and APIs provide the visibility third-party governance demands.

The Path Forward

Security governance in 2026 requires operational frameworks that deliver continuous visibility, measurable risk reduction, and executive-appropriate reporting – not just compliance documentation.

The regulatory environment will only intensify. Breach disclosure requirements expand. Financial materiality standards for cybersecurity tighten. Cyber insurance underwriting becomes more rigorous. Each trend increases pressure on governance programmes to demonstrate actual effectiveness.

CISOs who position governance as operational discipline with continuous measurement will navigate from positions of strength. Those treating it as annual compliance exercise will constantly react to audit findings and regulatory inquiries.

The technology foundation exists: continuous assessment platforms, automated compliance mapping, validated vulnerability intelligence, and executive risk translation. The strategic question is whether your organisation leverages these capabilities to build risk-aware governance that boards can understand and regulators can verify.

Ready to build operational security governance? Start here.