In the world of mergers and acquisitions, cybersecurity has become a critical factor that can make or break a deal. Most M&A transactions involve rapid integration of different IT systems, applications, and data assets. This process exposes acquiring companies to unknown vulnerabilities, legacy systems, and potentially active breaches.

The financial implications are severe. According to Gartner, incomplete cybersecurity due diligence can lead to regulatory penalties, reputation damage, and significant financial loss.

The M&A Cybersecurity Challenge

When you acquire a company, you’re also acquiring their security problems. Hidden vulnerabilities in legacy systems. APIs exposed to the internet. Misconfigured cloud assets. These risks often surface after the deal closes, when remediation becomes exponentially more expensive.

Post-acquisition breaches can cost millions in emergency patching, forensic investigations, and system overhauls. Regulatory fines under GDPR or CCPA add further damage. Customer trust, once lost, takes years to rebuild.

How Edgescan Addresses These Risks

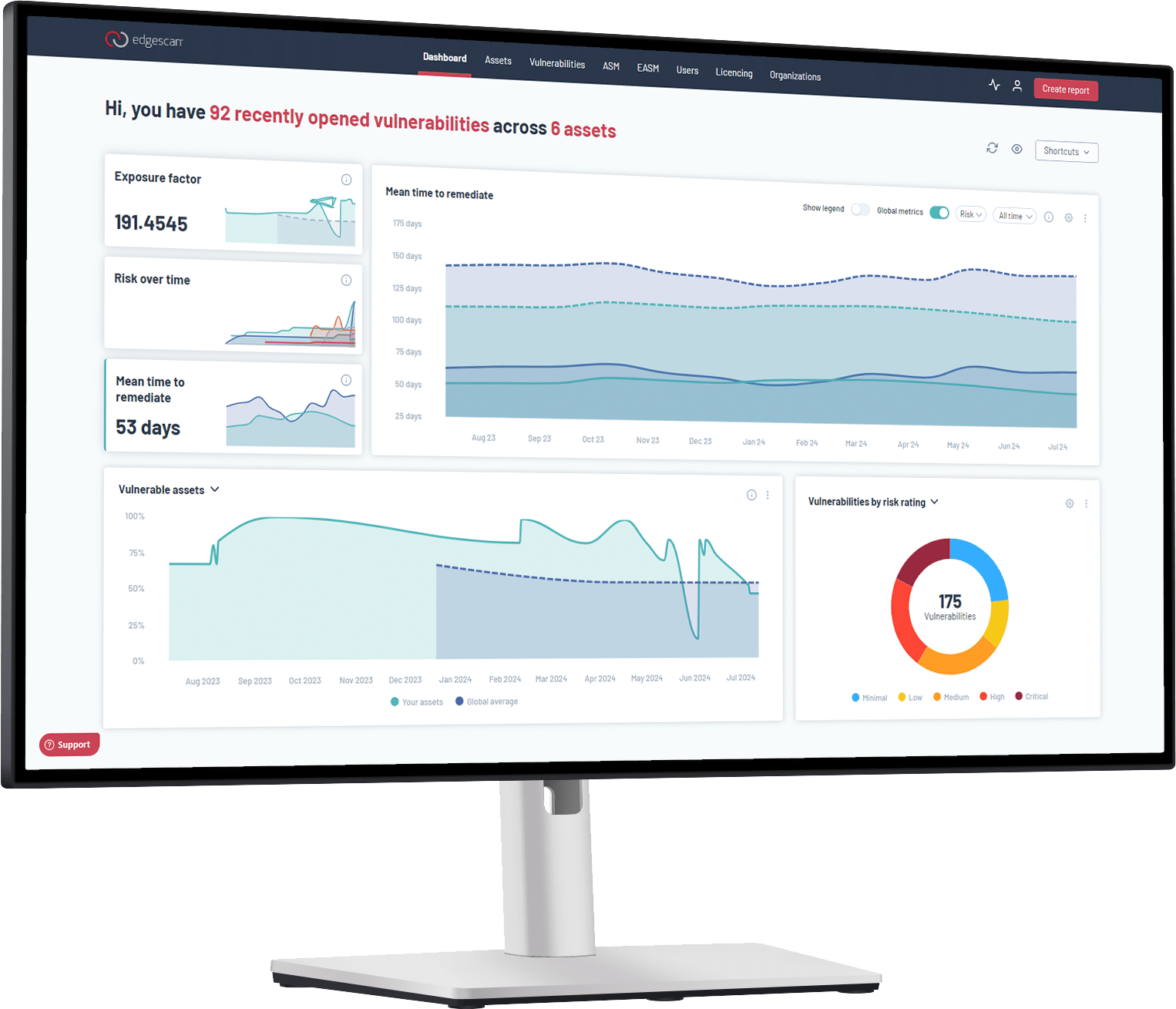

Edgescan provides end-to-end vulnerability management that identifies and validates threats across the entire digital estate of both acquiring and target companies.

Continuous Attack Surface Management discovers and profiles all digital assets – web applications, APIs, and network infrastructure. No asset goes unassessed.

Validated Vulnerability Assessments combine automated scanning with human validation by CREST and OSCP-certified analysts. This reduces false positives and prioritizes real threats over scanner noise.

Seamless Integration enables smooth onboarding of target company assets into the acquiring firm’s cybersecurity ecosystem. Visibility and control continue throughout the transition.

Risk-Rated Reporting provides actionable insights with clear priorities. Security teams focus on critical vulnerabilities first.

Real-World Impact: A 2025 Case Study

Early in 2025, Edgescan performed cybersecurity due diligence for a large enterprise acquiring a mid-sized technology firm. Our assessment uncovered several critical vulnerabilities in the target’s infrastructure, including unpatched systems, exposed APIs, and misconfigured cloud assets.

These findings were validated by our expert analysts and presented to the acquiring company’s executive team. As a direct result, the enterprise renegotiated the acquisition terms, reducing the purchase price by over $1,000,000.

This protected the buyer from future remediation costs while demonstrating the strategic value of incorporating cybersecurity intelligence into M&A negotiations.

The Bottom Line

Cybersecurity is no longer a post-acquisition concern – it’s core M&A strategy. Early detection of vulnerabilities transforms risk into negotiation leverage. Critical findings become cost savings opportunities.

Edgescan empowers organizations to make informed decisions by providing deep visibility into target companies’ security posture. Through continuous monitoring and validated assessments, we protect acquiring firms from hidden risks while delivering measurable cost savings.

Ready to secure your next acquisition? Start here.