Europe is eliminating payment delays. Single Euro Payments Area (SEPA) is and EU initiative that makes it easy for people and businesses to send and receive euro payments safely across Europe. SEPA Instant Payment Regulation (IPR) is an EU regulation that ensure that every citizen and business can send and receive money within seconds and any day of the year.

Banks across the Eurozone must now process payments within 10 seconds, operate 24/7/365, and match fees to regular SEPA transfers. The first compliance deadline hit January 9, 2025. More follow through 2027.

But speed creates security challenges. When money moves instantly, there’s no time to catch fraud or reverse suspicious transactions. Financial institutions face new risks while racing to meet regulatory deadlines.

The SEPA IPR Requirements

The regulation demands specific capabilities:

10-Second Processing: All instant payments must complete within 10 seconds. No exceptions.

Always-On Availability: Systems operate 24/7/365, including holidays and weekends.

Real-Time Verification: Banks must verify IBAN and name matches instantly.

Live Sanctions Screening: Compliance checks happen in real-time without delays.

Fee Parity: Instant payment costs cannot exceed regular SEPA transfer fees.

Compliance Timeline Reality

Eurozone banks face immediate pressure:

Receive instant payments: Already required (January 9, 2025)

Send instant payments: October 9, 2025

IBAN/name verification: October 9, 2025

Non-eurozone countries have until 2027, but preparation starts now.

Security Challenges of Instant Money

Speed introduces new attack vectors and operational risks:

No Reversal Window: Traditional fraud detection often relies on processing delays. Instant payments eliminate this safety net.

Expanded Attack Surface: New APIs, modified infrastructure, and real-time processing systems create additional vulnerability points.

24/7 Operational Risk: Continuous availability means no maintenance windows for security updates or system hardening.

Real-Time Processing Pressure: Sanctions screening and verification must happen instantly, potentially creating shortcuts in security protocols.

Beyond Compliance: Building Secure Payment Infrastructure

Meeting SEPA IPR requires more than feature development. Financial institutions need security frameworks that match the speed and availability demands.

Continuous Assessment: Traditional quarterly security reviews don’t work when systems change rapidly to meet regulatory deadlines. Continuous vulnerability scanning identifies issues as they emerge.

API Security Focus: Instant payments rely heavily on API integrations for real-time processing. These interfaces become primary attack targets and require specialized security testing.

Zero-Downtime Testing: With 24/7 operational requirements, security testing must happen without service interruption. This demands sophisticated testing approaches that work in live environments.

Rapid Remediation: When vulnerabilities are found in always-on systems, fixes must happen quickly without breaking instant payment availability.

Practical Security Measures

Financial institutions preparing for SEPA IPR should consider specific security practices:

Scope Expansion: Include all new and modified systems, APIs, and applications in security assessments. The rapid changes in infrastructure for IPR compliance often introduce overlooked vulnerabilities.

Retesting Protocols: Verify that all identified vulnerabilities are fully resolved. With tight compliance deadlines, incomplete fixes create ongoing risk.

Real-World Attack Simulation: Test how security measures perform under actual attack conditions, not just compliance scenarios.

According to the 2025 Edgescan Vulnerability Statistics Report, API-related vulnerabilities account for significant portions of critical security findings. With SEPA IPR’s heavy reliance on API infrastructure, this risk becomes particularly relevant for financial institutions.

How Edgescan Secures Instant Payment Infrastructure

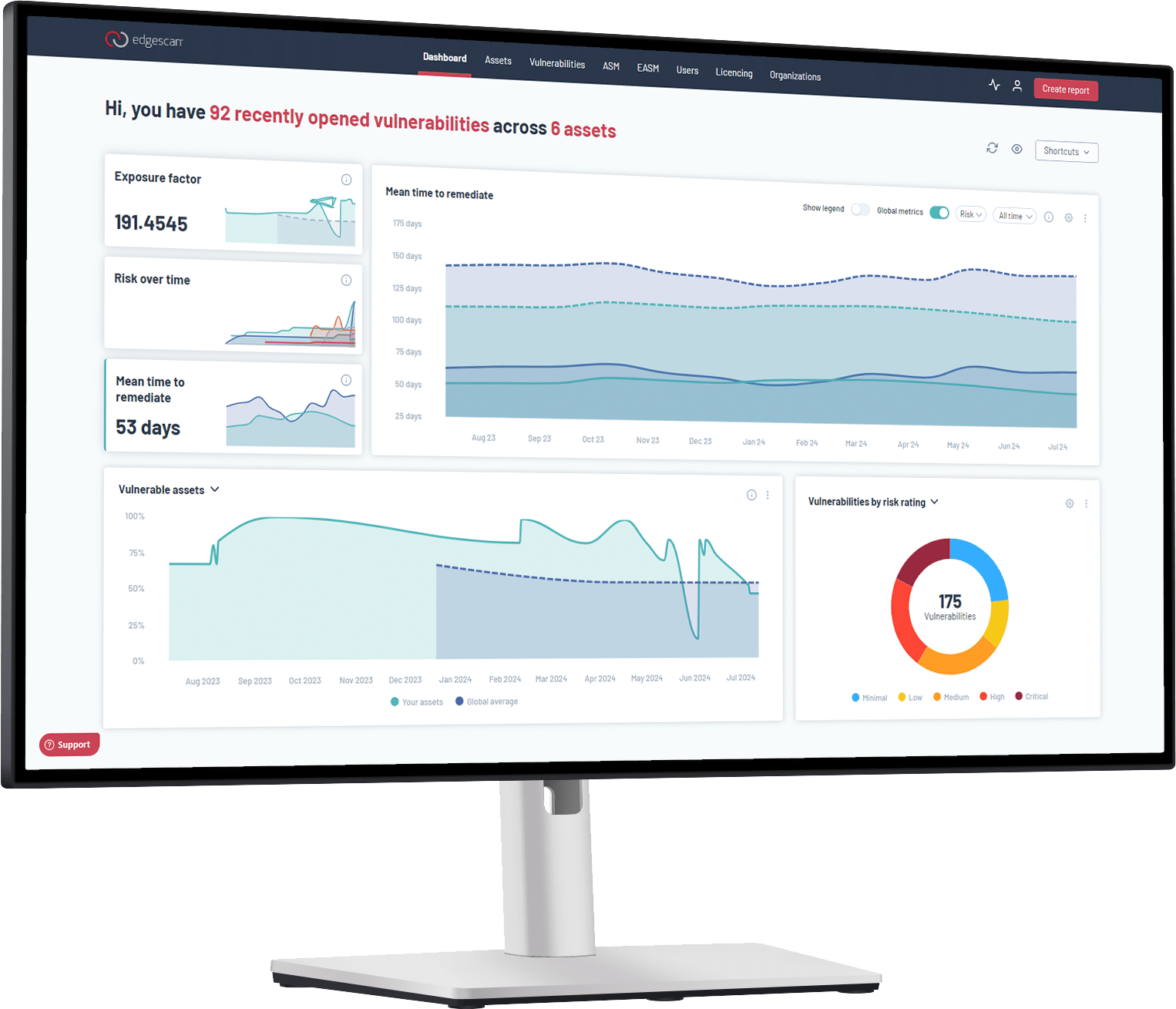

SEPA IPR compliance demands security solutions built for 10-second processing speeds with zero downtime. Edgescan’s approach addresses these specific challenges:

API Security for Real-Time Processing: SEPA IPR systems rely heavily on APIs for instant transactions. Edgescan provides comprehensive API discovery that continuously detects APIs across your external footprint, manual API penetration testing by certified experts, and continuous API vulnerability assessment with human-validated risks. Our cloud coverage ensures security across hybrid and multi-cloud infrastructures that instant payment systems require.

Continuous Vulnerability Management: Edgescan delivers continuous vulnerability scanning and assessment across both network infrastructure and application layers. This matters for SEPA IPR because systems change rapidly to meet compliance deadlines, and traditional quarterly assessments miss emerging risks.

Expert-Led Penetration Testing: Edgescan’s hybrid vulnerability management combines automated scanning with expert-led penetration testing services. Our certified professionals uncover hidden vulnerabilities that automated scans miss – critical for instant payment systems where a single flaw can expose real-time transactions.

Risk-Based Prioritization: Edgescan prioritizes vulnerabilities based on criticality, exploitability, and business impact. For SEPA IPR environments, this means focusing remediation efforts on threats that could disrupt instant payment availability or compromise transaction security.

Remediation Validation: Once vulnerabilities are fixed, Edgescan retests to confirm they’ve been fully resolved. This verification is essential for always-on instant payment systems where incomplete fixes create ongoing risk.

PCI-Level Standards: While not directly linked to SEPA IPR, Edgescan is a certified PCI ASV (Approved Scanning Vendor). We meet rigorous industry standards set by the PCI Security Standards Council, providing additional assurance of quality, credibility, and alignment with financial services best practices.

The Security-Speed Balance

SEPA IPR forces a fundamental question: How do you secure systems that must operate at unprecedented speed and availability?

The answer isn’t choosing between security and compliance. It’s building security measures that enhance rather than hinder instant payment capabilities. This requires tools and processes designed for the new reality of always-on, real-time financial infrastructure.

Ready to secure your instant payment infrastructure? Start here.